Managing finances can be a daunting task for individuals and families alike. With numerous expenses to keep track of and income to manage, it’s easy to feel overwhelmed. However, with the help of a semi-monthly home budget, you can divide your monthly expenses and income into two equal parts, making it easier to plan and manage your finances effectively.

This article will explore the benefits of using a semi-monthly home budget, how to create one, provide examples, and offer tips for successful budgeting.

What is a Semi-Monthly Home Budget?

A semi-monthly home budget is a financial tool that helps individuals and families plan and manage their finances by dividing monthly expenses and income into two equal parts. Typically, these budgets are based on a payment schedule where expenses are paid on the 15th and last day of each month.

By organizing financial obligations into semi-monthly periods, individuals can better understand their cash flow and make informed decisions about spending and saving.

Why Use a Semi-Monthly Home Budget?

There are several reasons why using a semi-monthly home budget can be beneficial:

- Improved Financial Organization: By breaking down monthly expenses into two equal parts, you can better track where your money is going and identify areas where you can cut back or save.

- Reduced Stress: Financial stress is common, but a semi-monthly home budget can help alleviate some of that stress by providing a clear picture of your financial situation and enabling you to plan.

- Effective Planning: With a semi-monthly budget, you can plan for upcoming expenses more efficiently, ensuring that you have enough funds available when bills are due.

- Goal Setting: A budget can help you set financial goals and track your progress towards achieving them. Whether it’s saving for a vacation or paying off debt, a budget provides a roadmap to reach your objectives.

How to Create a Semi-Monthly Home Budget

Creating a semi-monthly home budget is a straightforward process. Follow these steps to get started:

1. Determine Your Monthly Income

The first step in creating a budget is to calculate your monthly income. This includes all sources of income, such as salaries, wages, tips, and any additional earnings. Make sure to consider after-tax amounts to get an accurate figure.

2. List Your Monthly Expenses

Next, create a comprehensive list of your monthly expenses. Start by categorizing them into fixed expenses (rent/mortgage, utilities, insurance) and variable expenses (groceries, transportation, entertainment). Be sure to include any debt payments, such as credit card bills or loan installments.

3. Divide Your Expenses

Divide your total monthly expenses into two equal parts, one for each pay period. This will help you allocate your income accordingly and ensure that you have enough funds available for both halves of the month.

4. Adjust Your Spending

Review your expenses and identify areas where you can cut back or reduce costs. Look for discretionary expenses that can be minimized or eliminated. This will help you prioritize essential expenses and have more control over your finances.

5. Set Financial Goals

Once you have a clear understanding of your income and expenses, set financial goals for yourself. Whether it’s saving a certain amount each month or paying off debt, having specific goals will motivate you to stick to your budget and make better financial decisions.

6. Track Your Progress

Regularly track your expenses and income to ensure that you are staying on track with your budget. Keep receipts and use budgeting apps or spreadsheets to monitor your spending. This will help you identify any areas where you may need to adjust your budget or make changes to your spending habits.

7. Make Adjustments as Needed

A budget is not set in stone and may need adjustments over time. As your financial situation changes or unexpected expenses arise, be flexible and make the necessary adjustments to your budget. This will ensure that your budget remains realistic and effective.

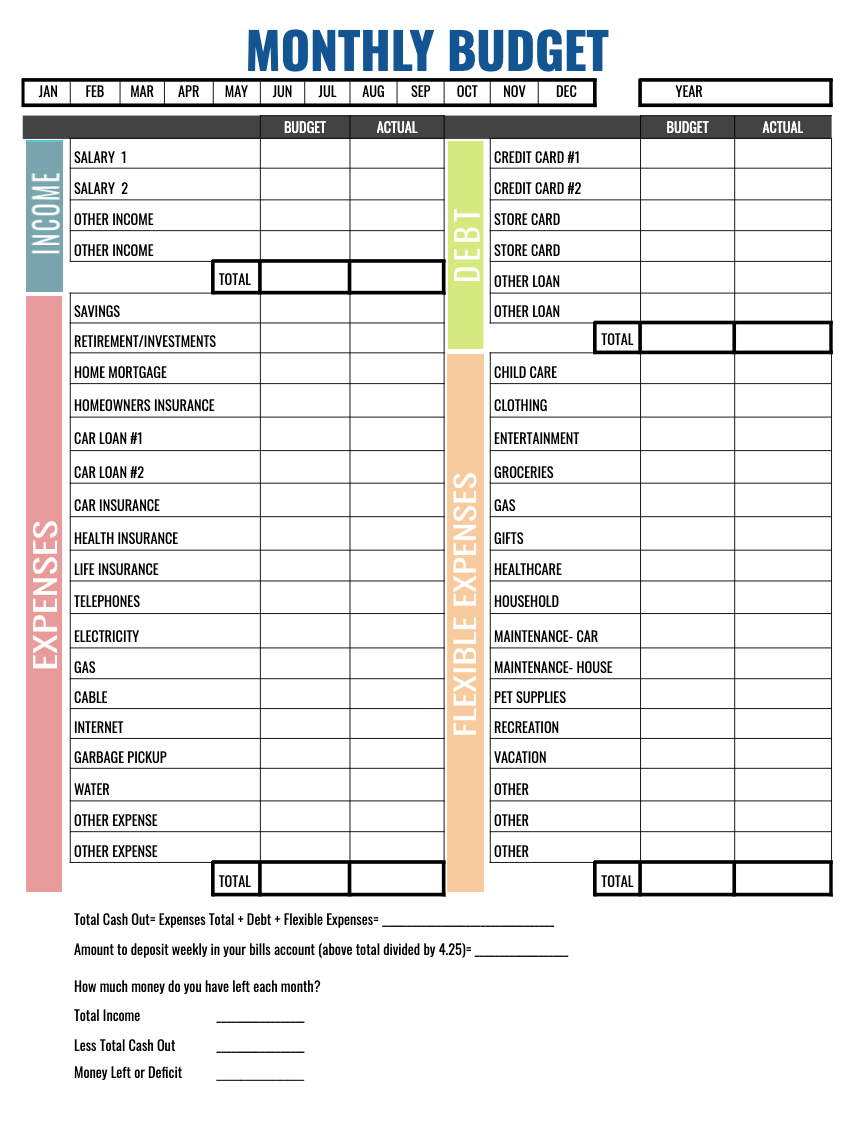

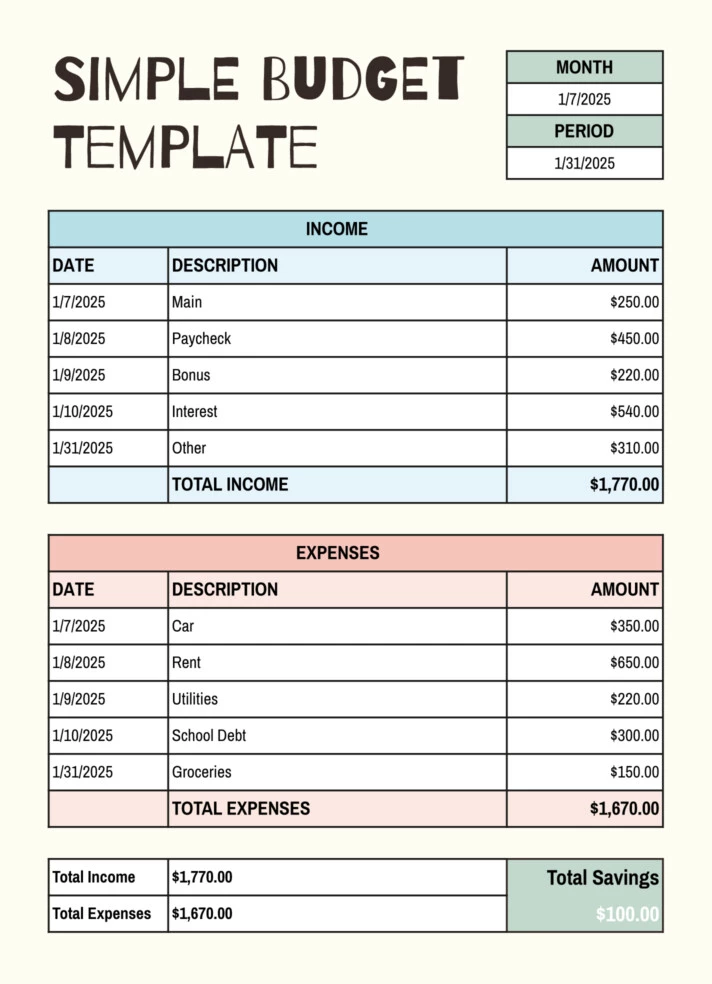

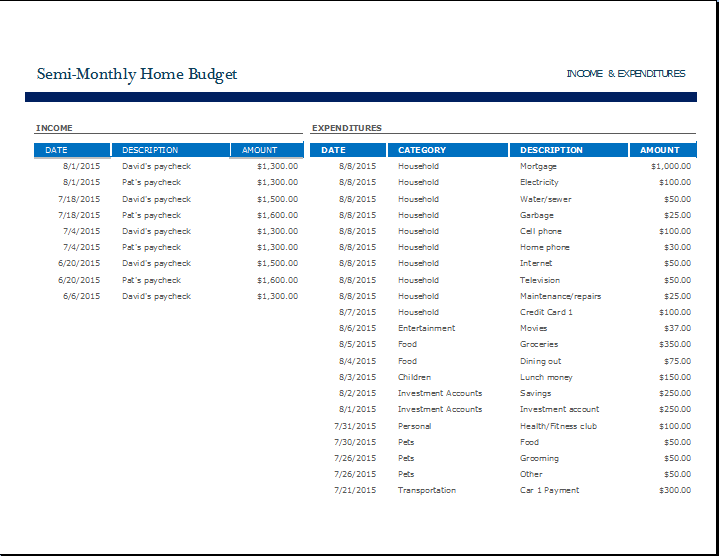

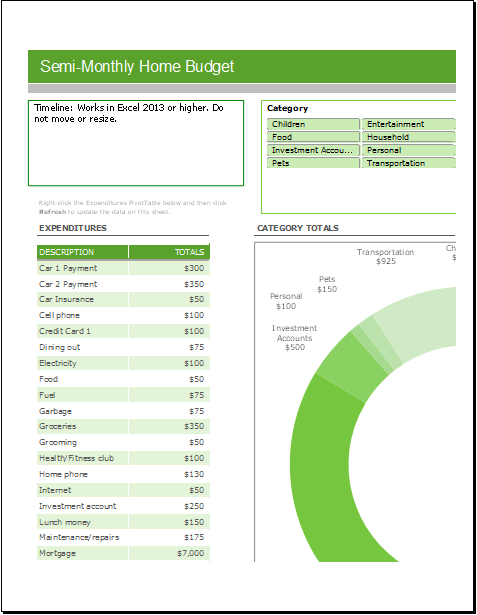

Examples of Semi-Monthly Home Budgets

Here are two examples of semi-monthly home budgets:

Tips for Successful Budgeting

Here are some tips to help you successfully manage your budget:

- Track Your Spending: Keep a record of every expense to understand where your money is going and identify areas where you can cut back.

- Automate Savings: Set up automatic transfers to a savings account to ensure that you save a portion of your income every month.

- Review and Adjust: Regularly review your budget and make adjustments as needed. Life circumstances change, and your budget should reflect those changes.

- Stay Disciplined: Stick to your budget and avoid impulsive spending. Make conscious decisions about your purchases and prioritize your financial goals.

- Involve the Whole Family: If you’re budgeting as a family, involve everyone in the process. Teach children about the importance of managing money and involve them in age-appropriate discussions about the family budget.

- Celebrate Milestones: When you achieve a financial goal or milestone, celebrate it! Rewarding yourself can help you stay motivated and committed to your budget.

- Seek Professional Help: If you’re struggling with your finances or need expert advice, don’t hesitate to seek help from a financial advisor or counselor.

In Conclusion

A semi-monthly home budget is a valuable tool for individuals and families looking to take control of their finances. By dividing monthly expenses and income into two equal parts, you can effectively plan and manage your money, reduce stress, and work towards your financial goals.

Use the steps provided in this article to create your budget and follow the tips for successful budgeting to ensure financial success.

Semi-Monthly Home Budget Sheet Template – Download