Managing personal or business finances can be a daunting task. It requires careful planning, budgeting, and tracking to ensure that you are on the right track and making informed financial decisions. One effective tool that can help individuals and businesses stay organized and motivated on their savings journey is a savings tracker.

This article explores the benefits of using a savings tracker, how to create one, and provides tips for successful savings tracking.

What is a Savings Tracker?

A savings tracker is a simple yet powerful tool that helps individuals and businesses visualize and monitor their savings progress towards specific goals. It provides a clear overview of savings, allows for the setting of targets, and can motivate individuals by showcasing their progress.

Whether you are saving for a vacation, a down payment on a house, or to grow your business, a savings tracker can be customized to suit your needs.

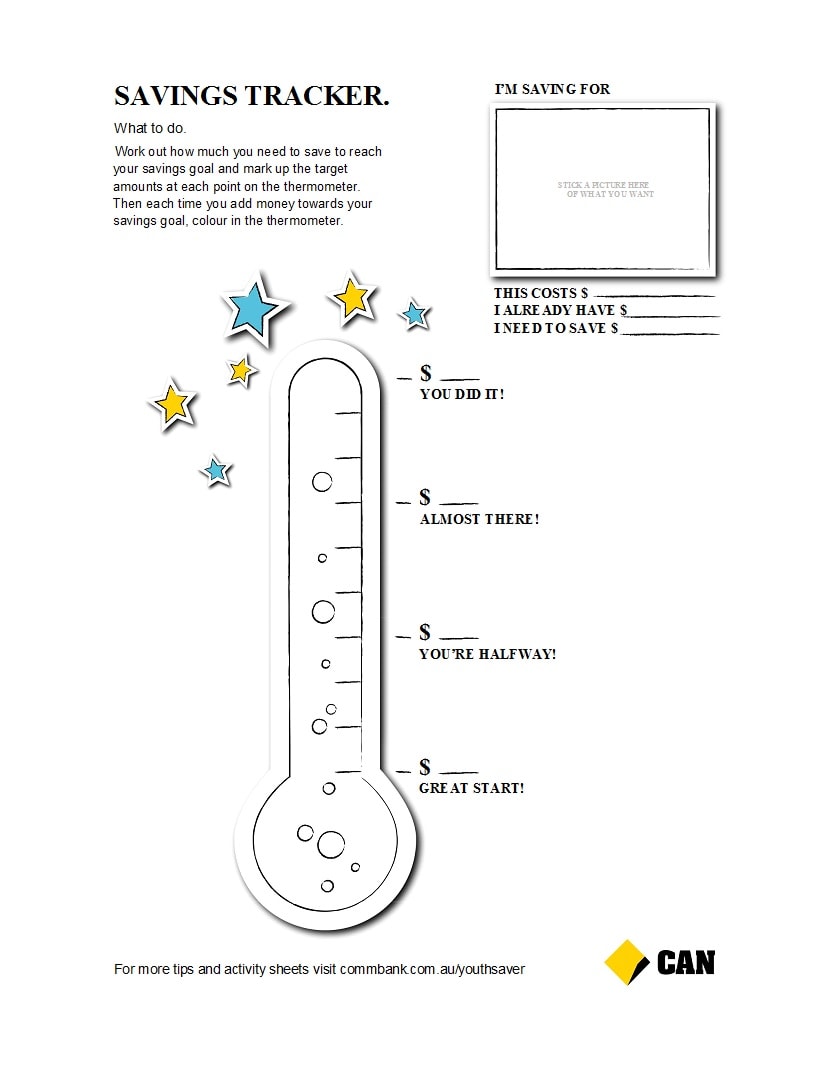

![]()

Why Use a Savings Tracker?

Tracking your savings progress using a savings tracker offers several advantages:

- Visualize your progress: A savings tracker provides a visual representation of your savings journey. It allows you to see how far you’ve come and how much closer you are to achieving your financial goals.

- Stay on track: By monitoring your savings regularly, you can identify any gaps or areas where you need to adjust your spending or saving habits. This helps you stay on track and make any necessary changes to ensure you reach your goals.

- Make informed financial decisions: A savings tracker gives you a clear overview of your finances. It helps you make informed decisions about where to allocate your savings, whether it’s towards a specific goal, investments, or emergency funds.

- Set targets: With a savings tracker, you can set specific targets for your savings based on your goals. This provides you with a clear roadmap and helps you stay motivated as you work towards achieving those targets.

- Motivate yourself: Seeing your progress on a savings tracker can be highly motivating. It serves as a visual reminder of your commitment and progress, boosting your confidence and encouraging you to keep going.

How to Create a Savings Tracker

Creating a savings tracker is easy and customizable to fit your needs. Here’s a step-by-step guide to help you get started:

1. Determine your financial goals:

Before creating a savings tracker, it’s important to identify your financial goals. Whether it’s saving for a vacation, paying off debt, or starting an emergency fund, having clear goals will help you stay focused and motivated throughout your savings journey.

2. Choose a savings tracker template:

There are numerous savings tracker templates available online, or you can create your own using spreadsheet software like Microsoft Excel or Google Sheets. Look for a template that aligns with your goals and preferences.

3. Customize the template:

Once you have chosen a template, customize it to fit your needs. Add categories for your goals, set target amounts, and determine the timeframe for achieving each goal. You can also personalize the design by adding colors or graphics that inspire you.

4. Print the tracker:

After customizing the template, print multiple copies of the savings tracker. Consider using high-quality paper or cardstock to ensure durability.

5. Track your savings:

Start using the savings tracker by recording your savings progress regularly. Update the tracker whenever you make a deposit or reach a milestone.

Tips for Successful Savings Tracking

Here are some tips to help you make the most out of your savings tracker:

- Be consistent: Make it a habit to update your savings tracker regularly. Set a specific time each week or month to review and record your progress.

- Be realistic: Set achievable savings targets based on your income and expenses. It’s important to strike a balance between challenging yourself and setting goals that are within reach.

- Celebrate milestones: Celebrate your progress along the way. When you reach a milestone or achieve a savings goal, reward yourself in a way that aligns with your financial objectives.

- Review and adjust: Periodically review your savings tracker to assess your progress. If necessary, adjust your goals, targets, or savings strategies based on changing circumstances or priorities.

- Stay motivated: Keep yourself motivated by visualizing the end result. Use images or quotes that inspire you on your savings tracker to remind yourself why you are saving and the benefits it will bring.

- Share your progress: Consider sharing your savings journey with a trusted friend or family member. Having someone to hold you accountable can provide additional motivation and support.

- Track other financial metrics: In addition to savings, consider tracking other financial metrics such as expenses, debt repayment, or investment returns. This will give you a holistic view of your financial health and help you make better decisions.

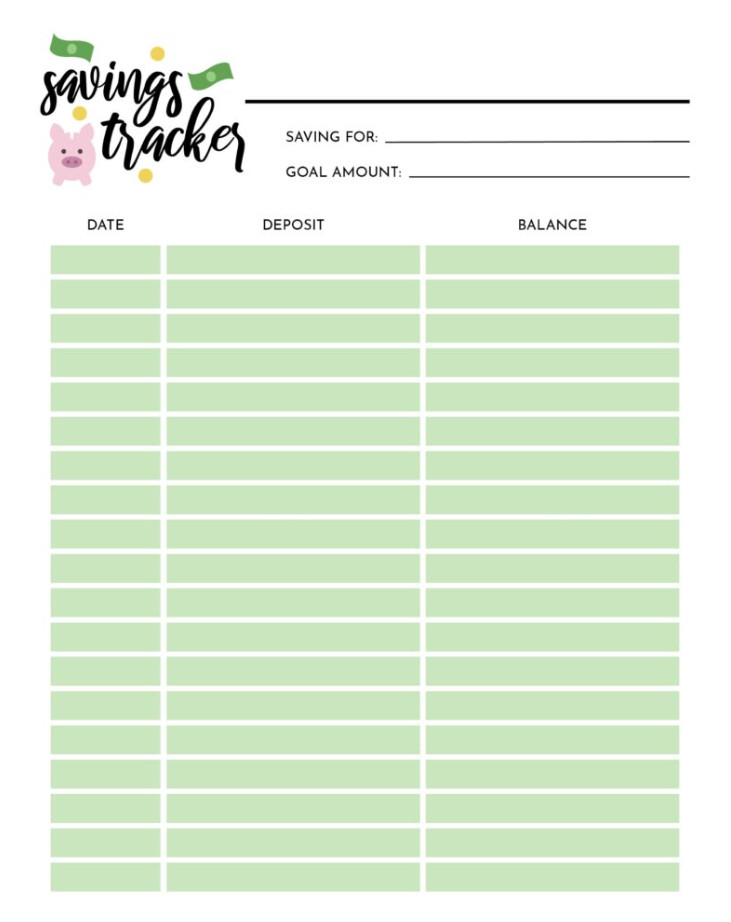

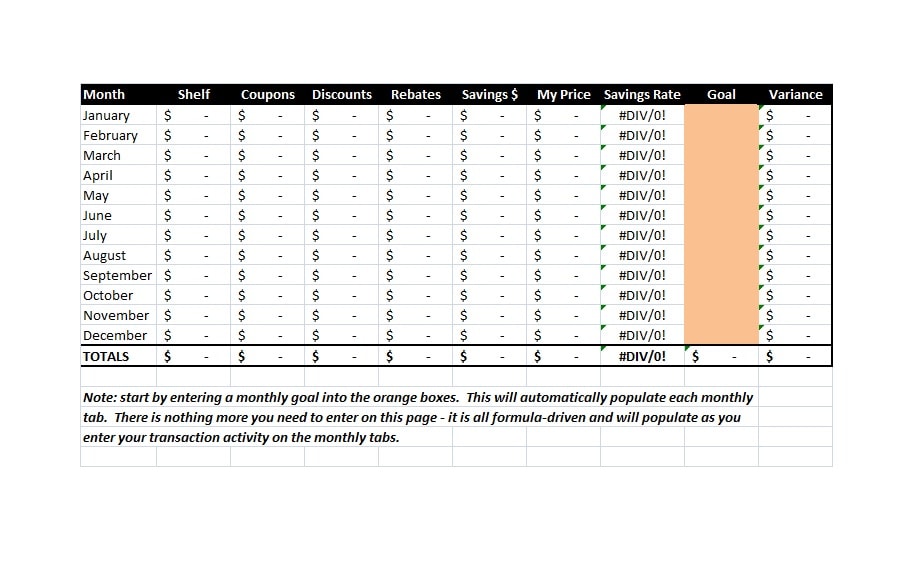

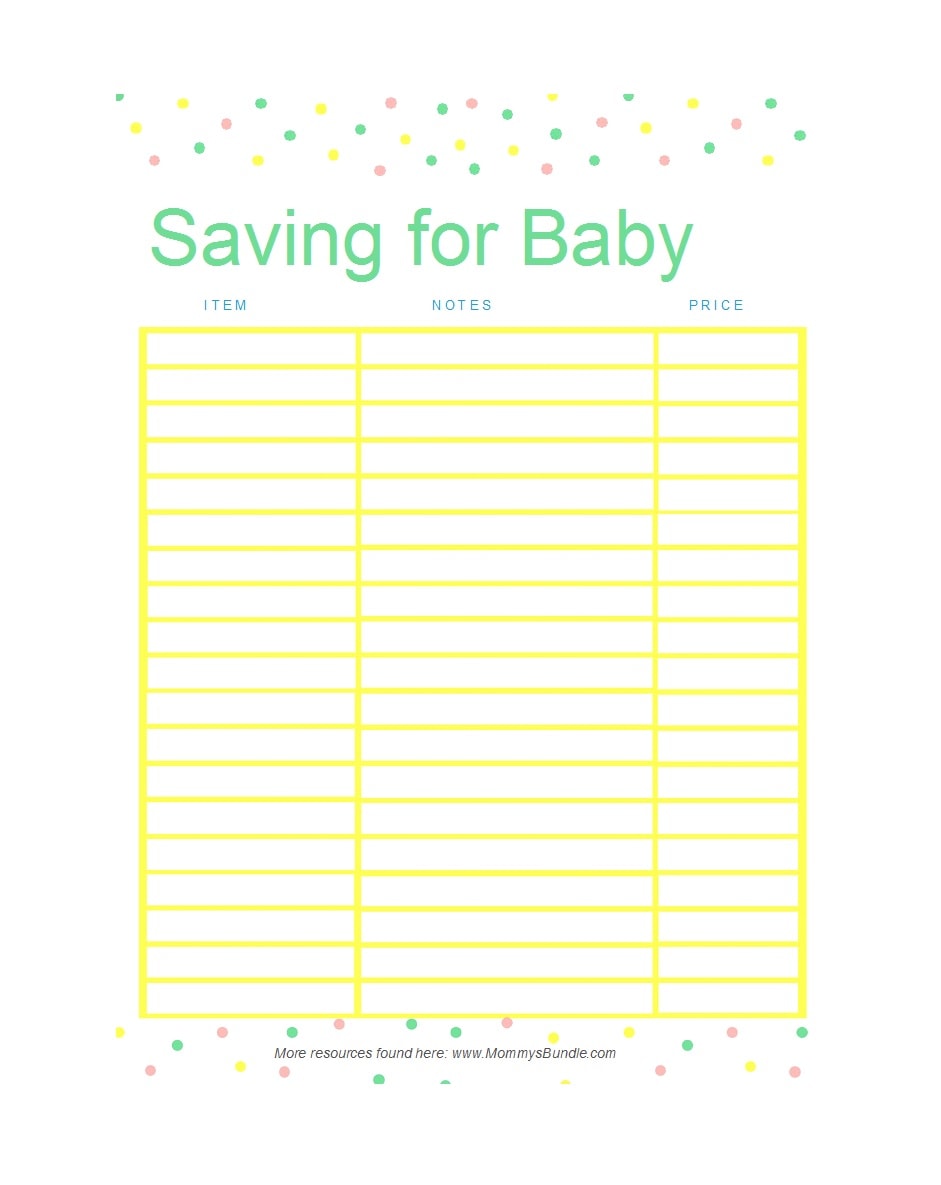

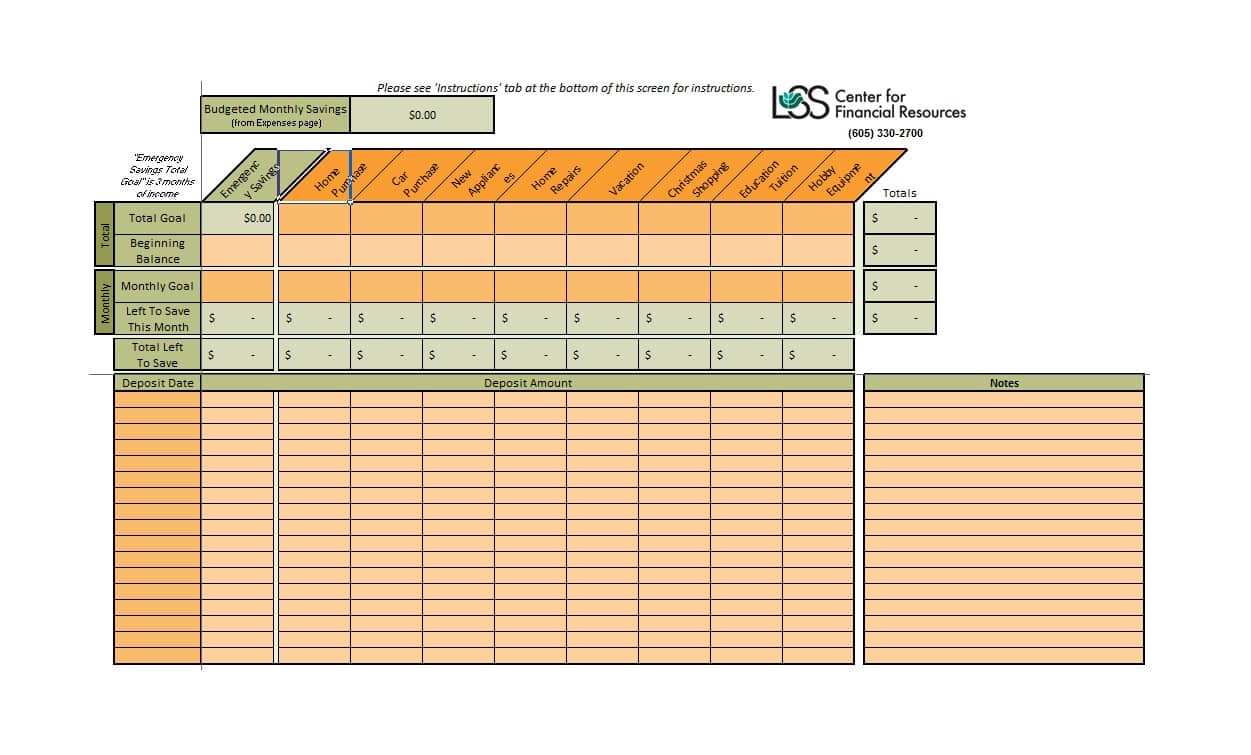

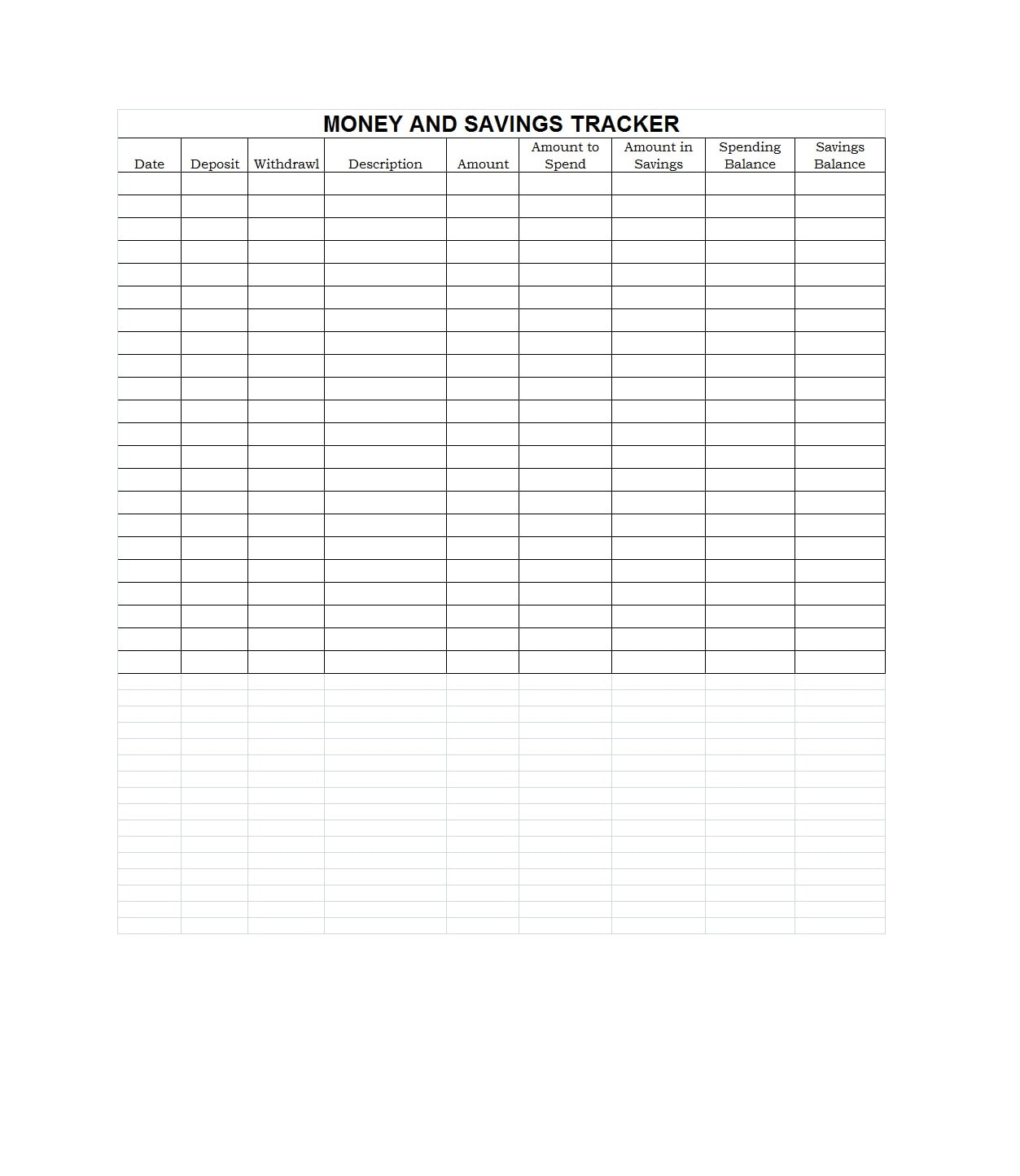

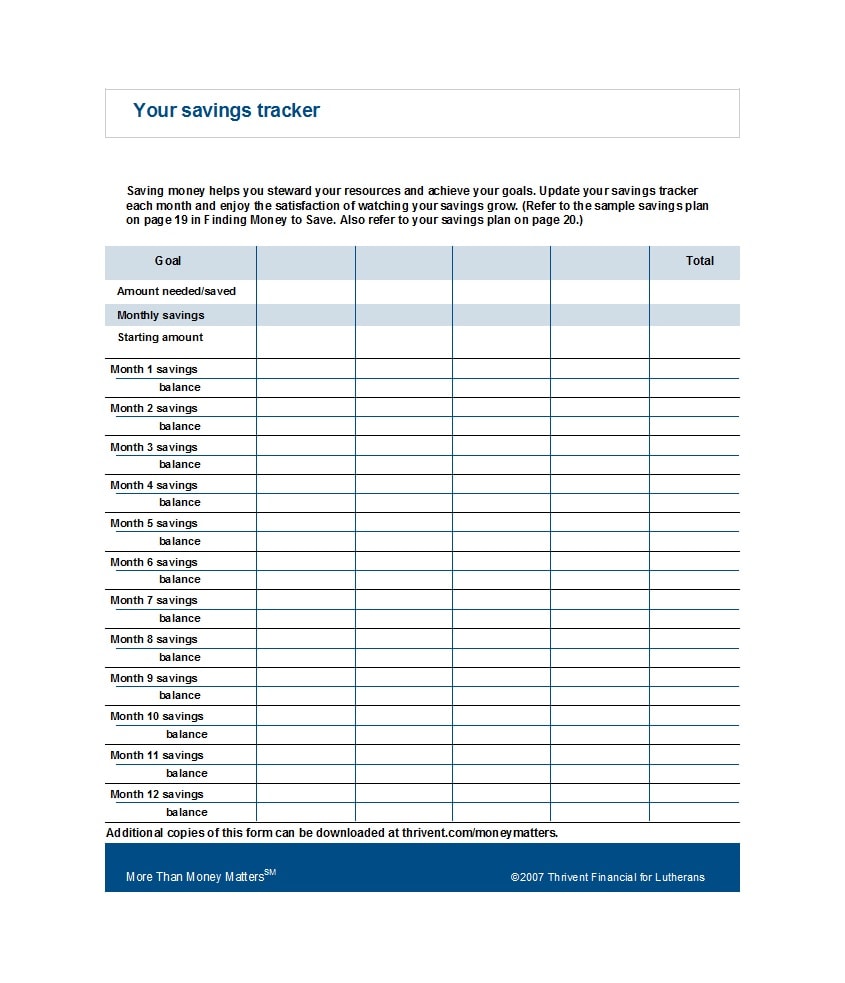

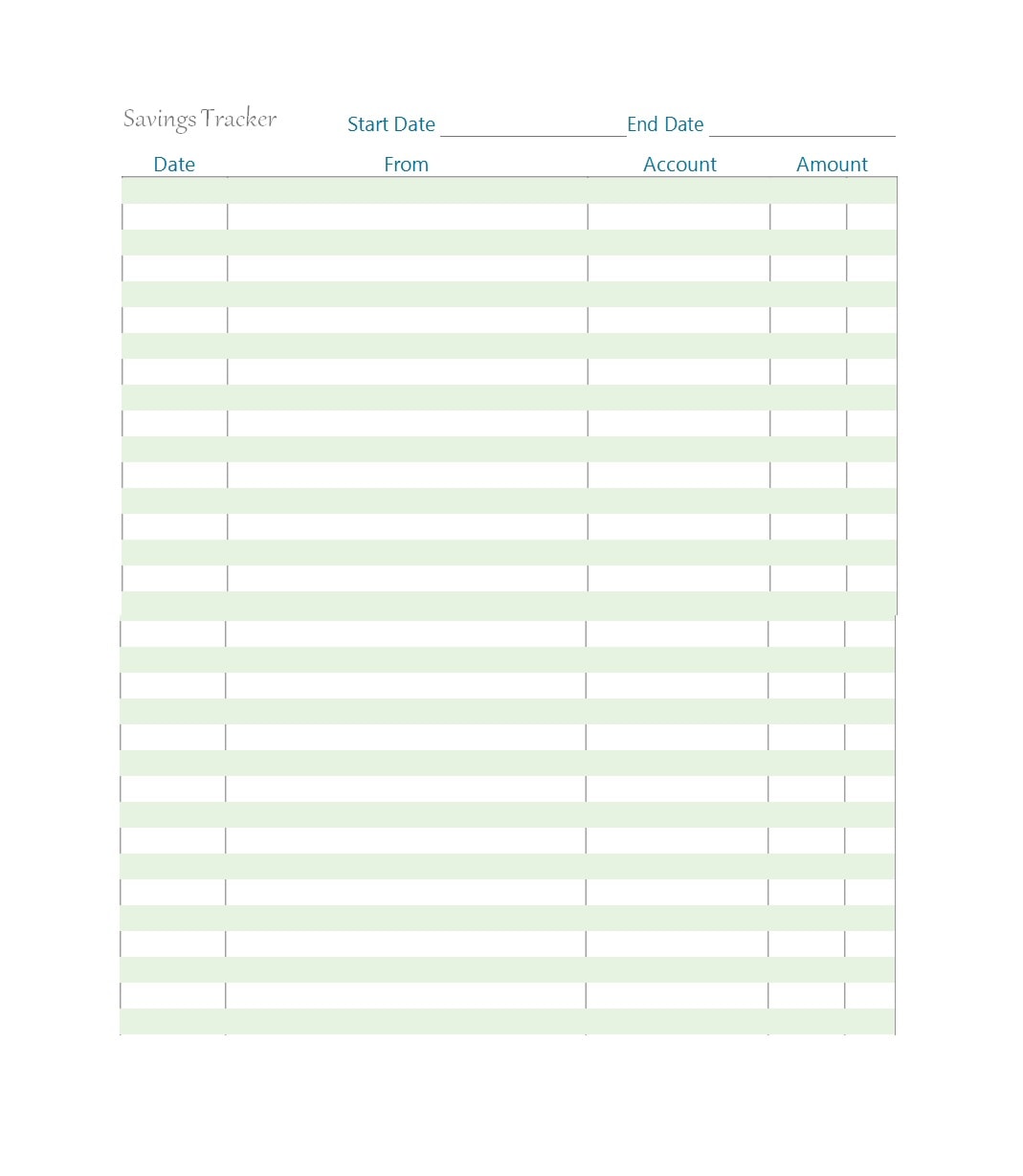

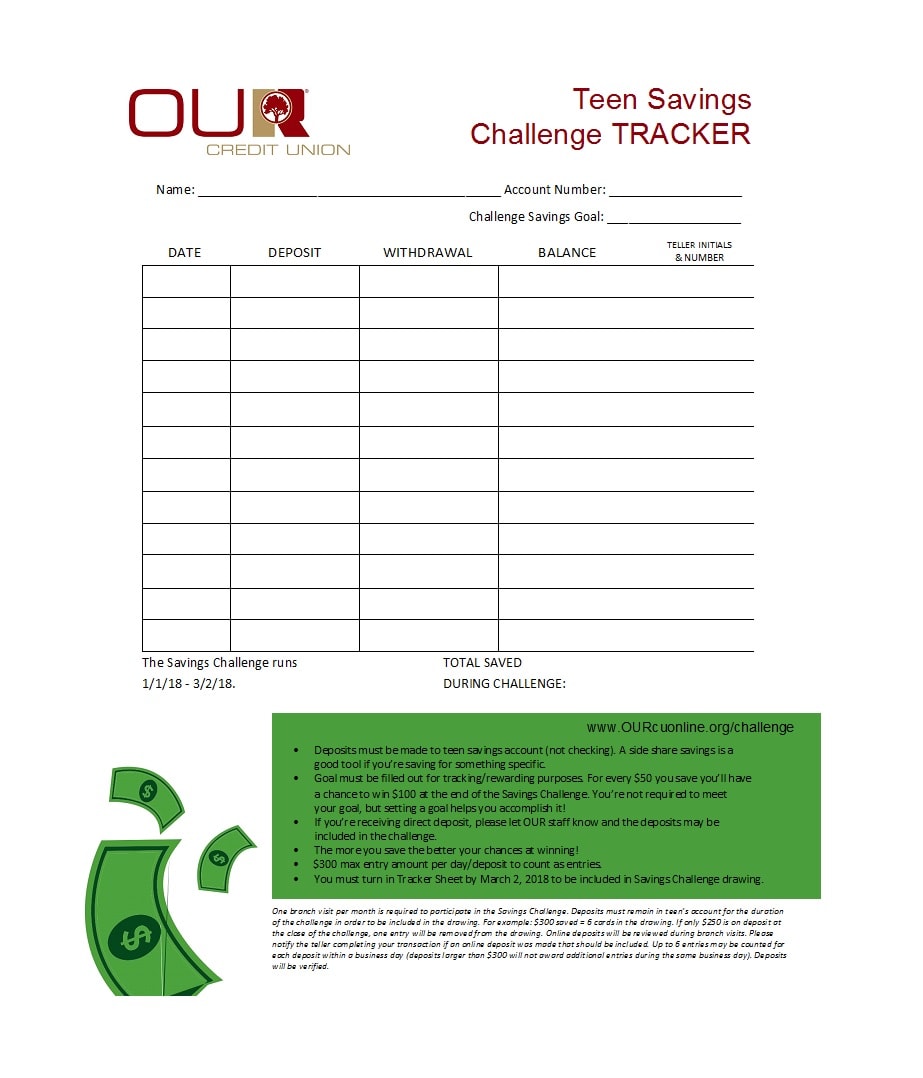

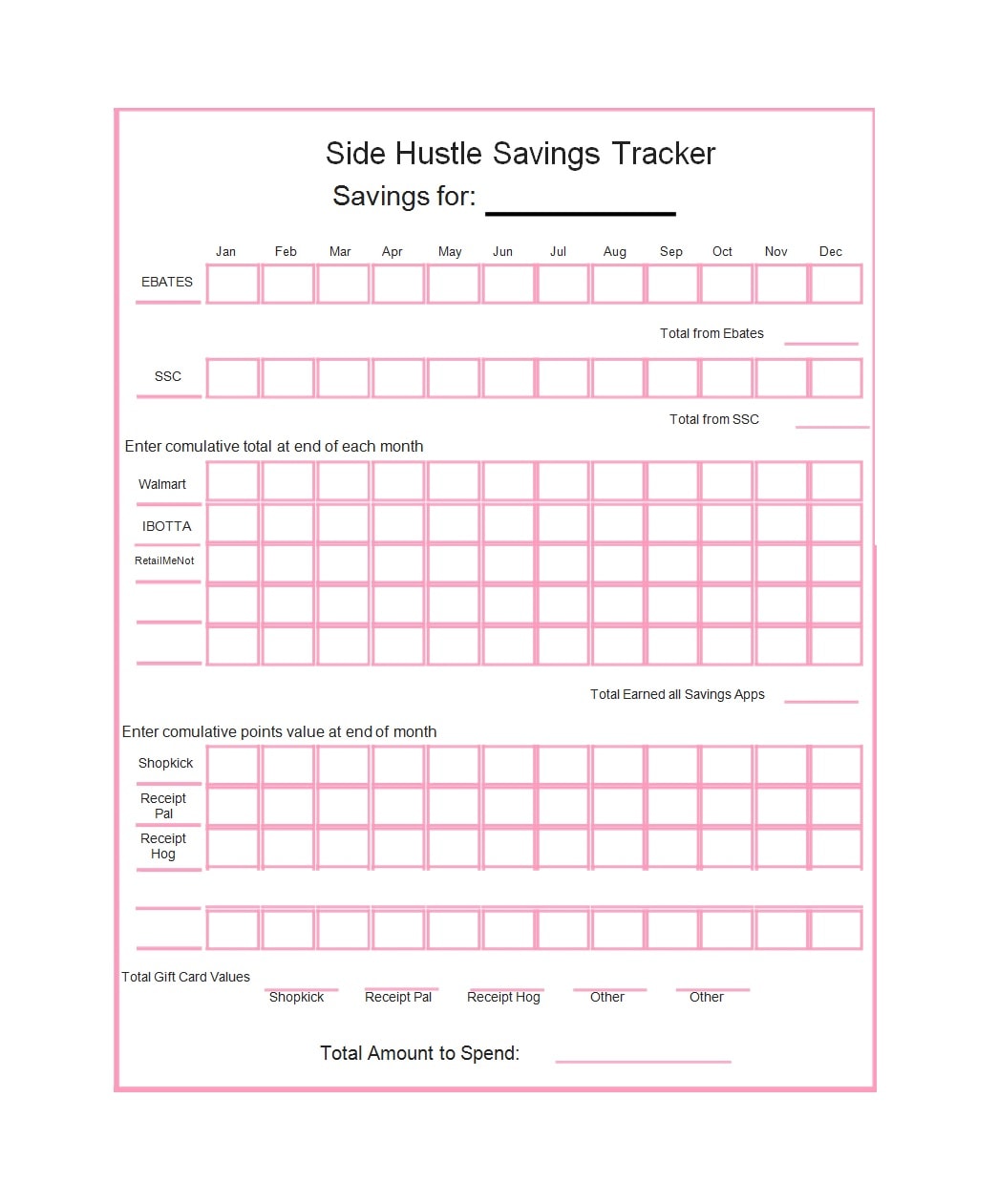

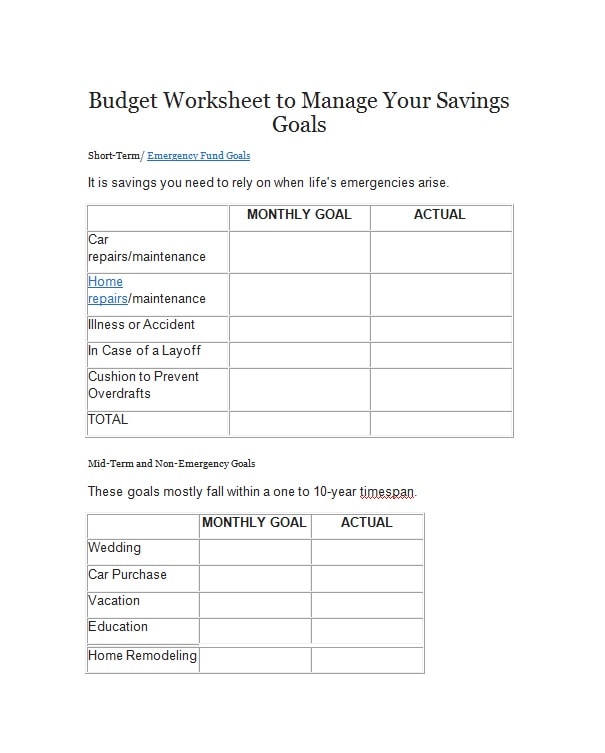

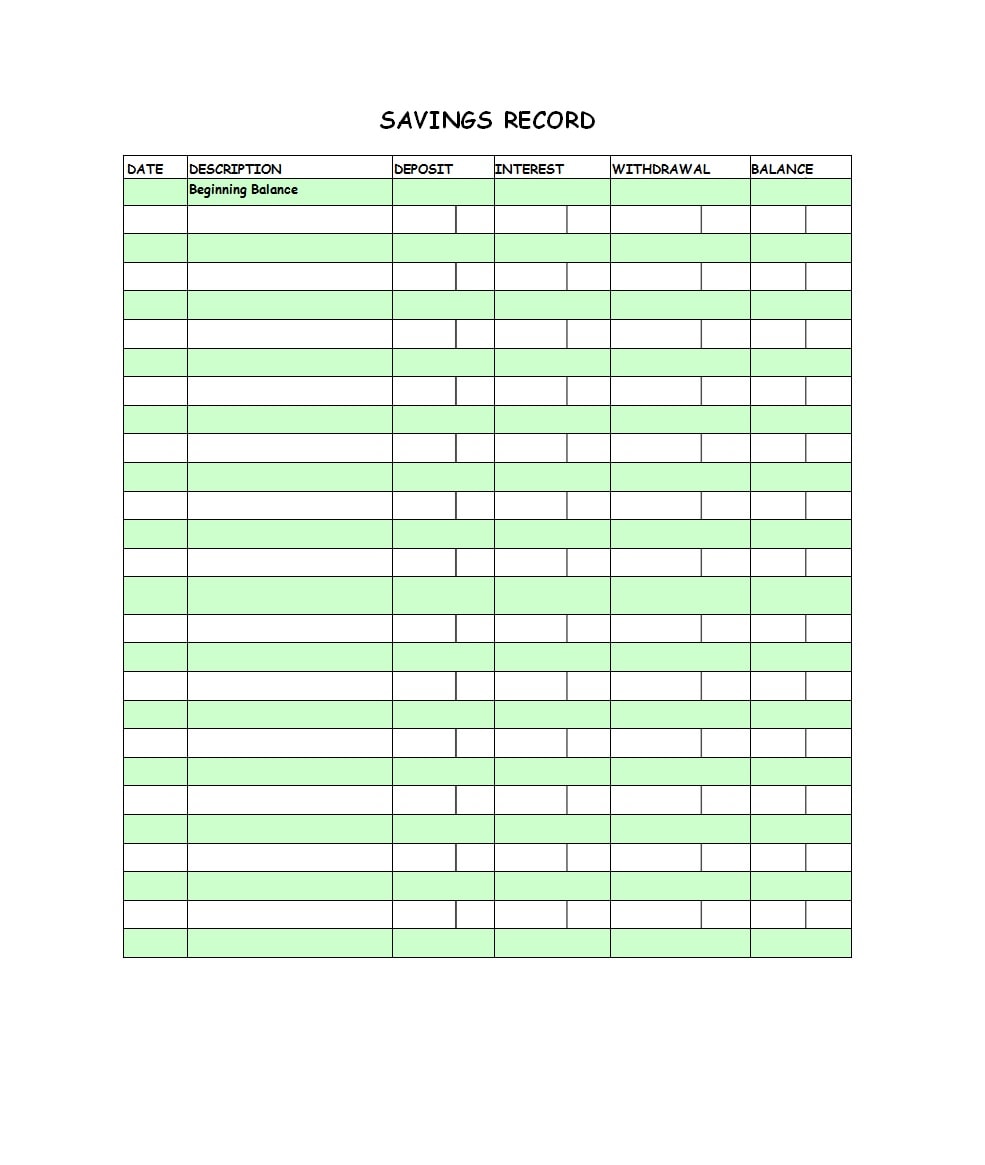

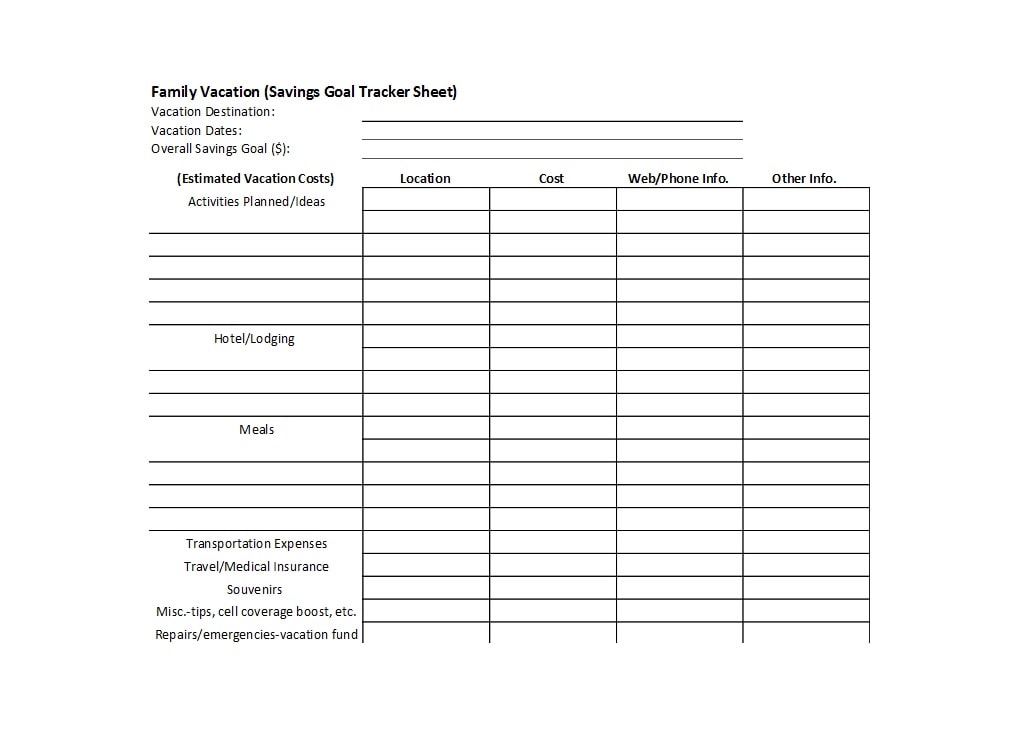

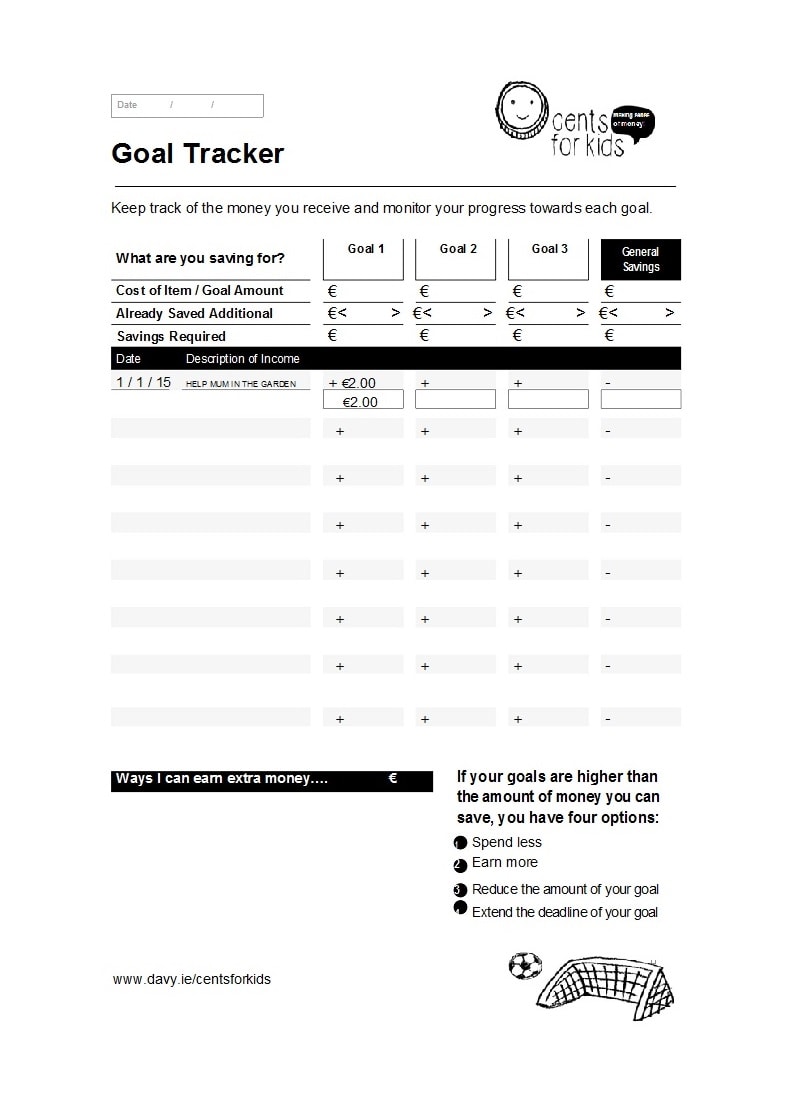

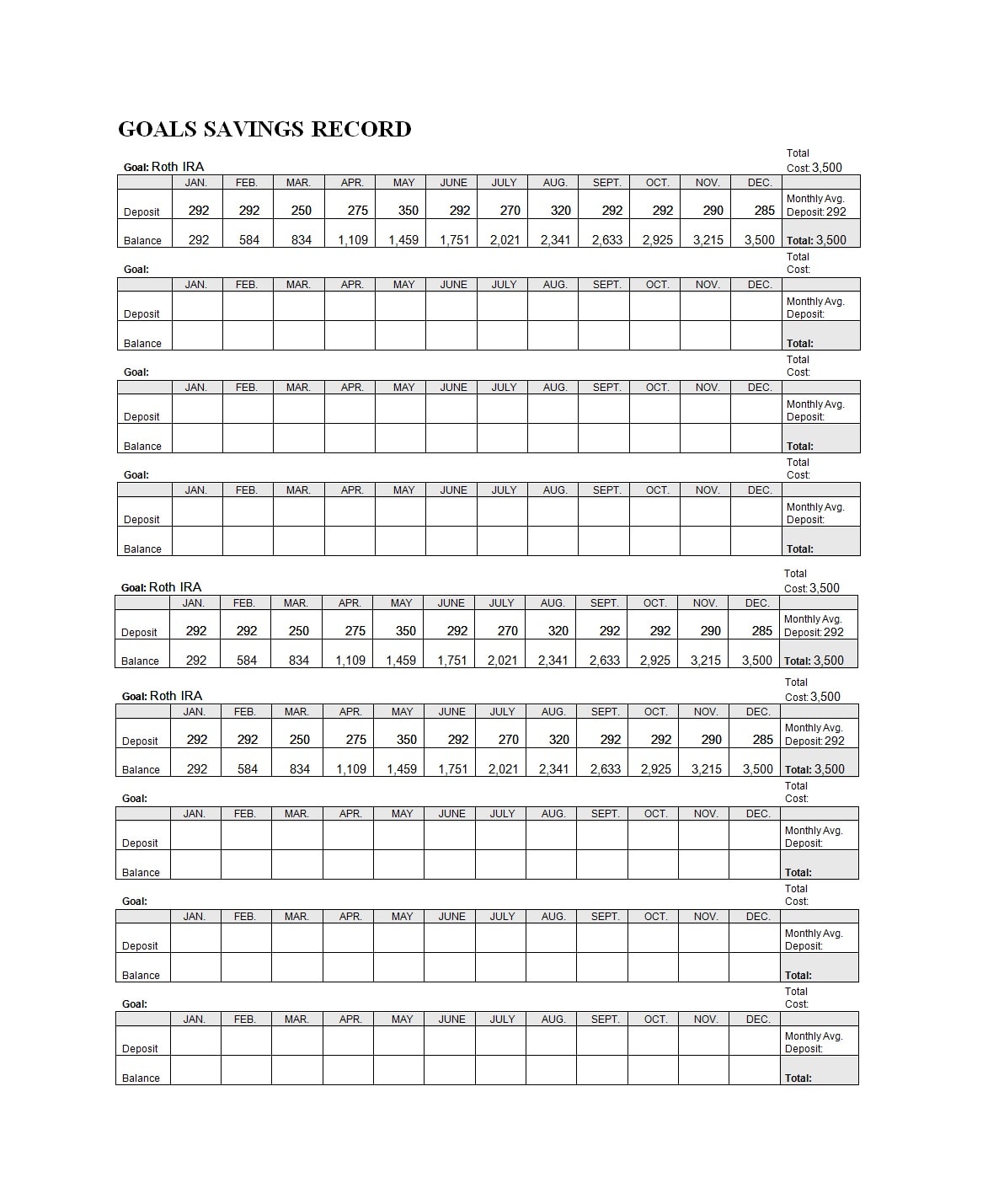

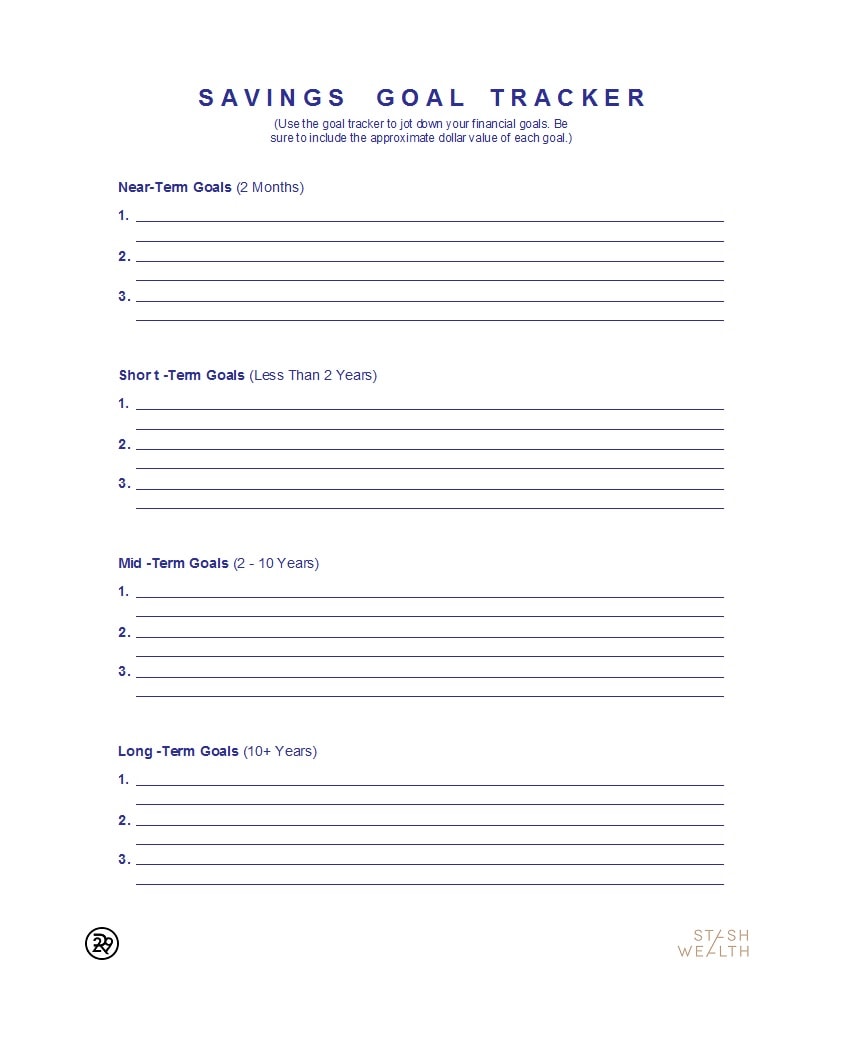

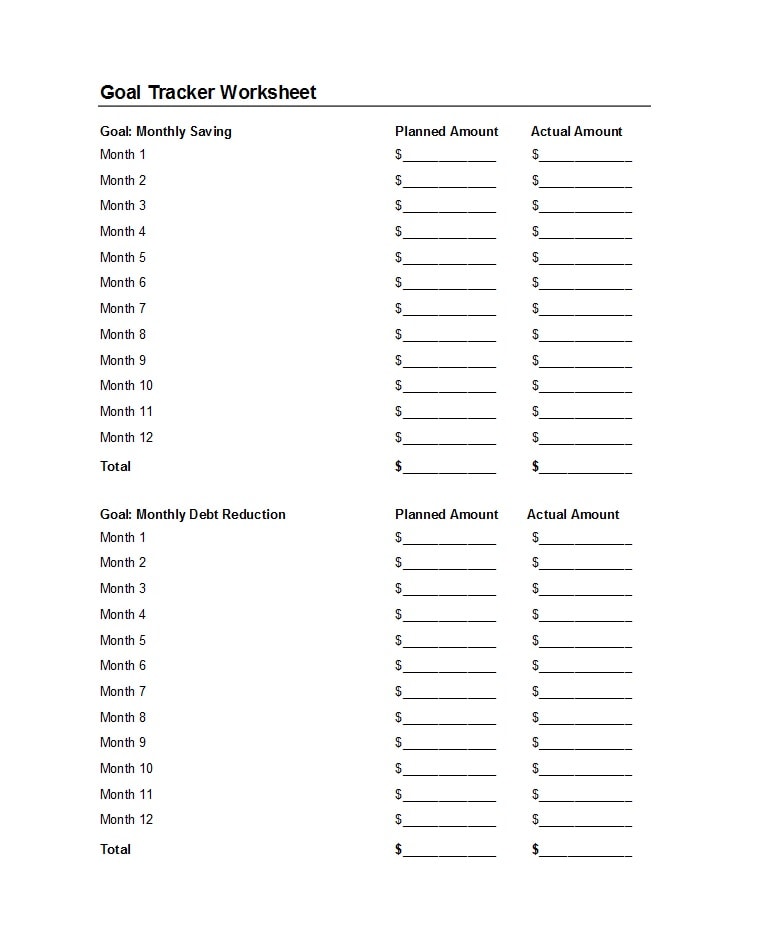

Examples of Savings Trackers

Here are some examples of savings trackers:

Conclusion

A savings tracker is a valuable tool that can help individuals and businesses visualize and monitor their progress towards specific financial goals. By providing a clear overview of savings, allowing for the setting of targets, and showcasing progress, a savings tracker can keep you motivated, informed, and on track towards achieving your financial aspirations.

Start using a savings tracker today and take control of your financial future.

Savings Tracker Template – Download